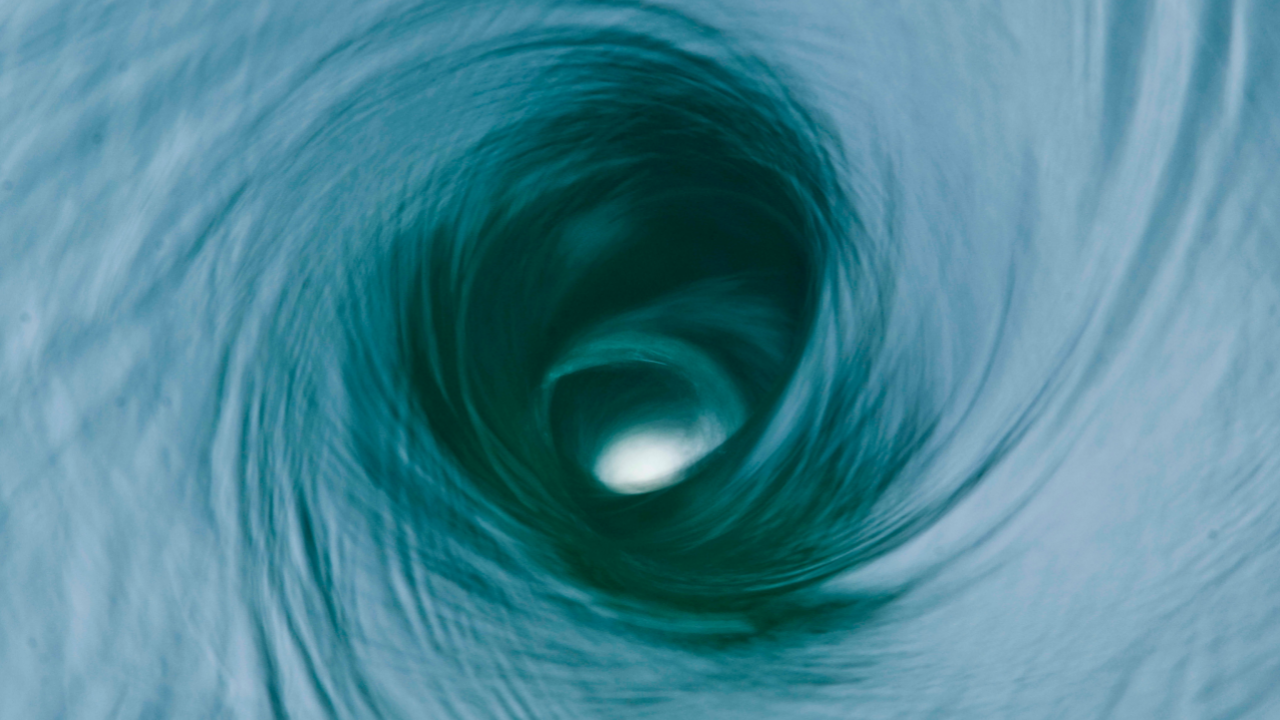

Bad debt drains life’s energy

Jul 22, 2021

In an earlier posting, I wrote how debts can be a choice. Today I’ll explore the mental toll that bad debts take.

When it comes to issuing debt, banks use formulas based on occupation, income levels, and existing obligations to determine whether a borrower is a safe bet.

And often, doctors are given whatever they request.

But sustainable debt has less to do with numbers and more to do with your mindset.

Because most of us have one, I’ll use the example of a mortgage.

In some markets, it can consume 30% or more of gross billings.

It gets worse: Remember that payments reflect after-tax earnings in top brackets. Your $5000 per month mortgage is now more than $8000 of earned income.

Worse still: you’re paying large personal tax bills just to cover additional thousands in property taxes.

So, is this debt a joy or a burden?

Here are the real questions to be asked about bad debt:

How many clinical hours per month (or years in my life) will I have to work to pay off this off?

If something happens to me, will my spouse or partner be able to carry it?

Am I truly happy?

This was a controversial topic because it goes against conventional wisdom in housing.

But at Physician Empowerment, we strive to be honest with ourselves and share from heart.